Many politicians (and economists) don’t seem to understand the relationship between unemployment and inflation. It should be obvious that when unemployment is high, consumers who make up 70 percent of the economy don’t spend much, and therefore can’t push up prices. But tell that to the ideologues, who claim that the fear of future inflation is what keeps employers from hiring.

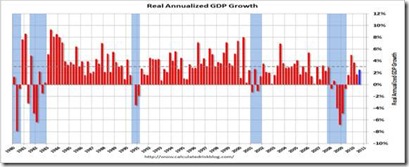

Well, since Q3 Gross Domestic Product growth was just revised upward to 2.5 percent with declining inflation, and real GDP growth is up 3.2 percent in 12 months, we hope that canard is being put to rest.

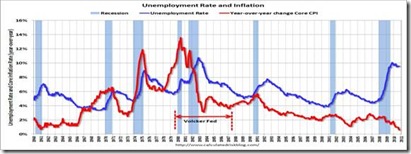

The best way to look at the behavior of inflation vs. unemployment is the historical record. CPI inflation peaked in 1980 at 13.5 percent, and caused Fed Chairman Paul Volcker to raise interest rates into double digits. The unemployment rate was hovering around 6 percent then. Once the unemployment rate rose above 10 percent due to the Fed’s tightening, inflation plunged below 4 percent.

And the inflation rate has been trending downward ever since. In fact, there has never been appreciable inflation with an unemployment rate above 6 percent. And since no economist sees the unemployment rate improving much before 2011, if then, we know why the Fed is so concerned about deflation.

The increase in Q3 GDP was led by consumers and exports, as the cheaper dollar overseas is increasing manufacturing, in particular. Exports are up over 14 percent, while consumers are opening their wallets for the holiday season. Final sales in Q3 to domestic purchasers—the best measure of consumer demand—increased to 2.9 percent.

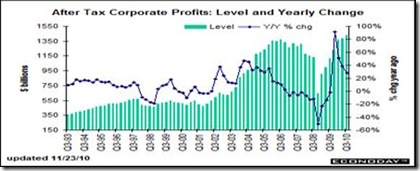

Consumer spending is beginning to lift growth, in other words, as are increasing Q3 corporate profits, up 28 percent in a year. But businesses cannot continue to produce more without hiring more employees. The severity of this 2007-09 recession is shown in the 30-year record of GDP growth by Calculated Risk (blue bars are recessions), which was negative for 6 quarters during this recession. The average annual Q3 growth rate is again above 3 percent.

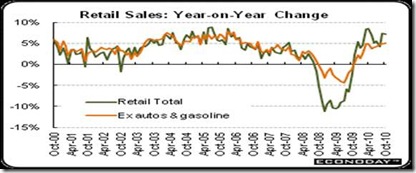

Retail sales are the best measure of consumer spending, and sales are soaring again. With four impressive gains in a row, it is becoming apparent that the consumer sector is stronger on the spending side than would be suggested by high unemployment and low measures of consumer confidence. On a year-ago basis, retail sales are up a huge 7.3 percent in October and, after excluding autos and gasoline, up 5.2 percent. Those with jobs appear to have decided that it is safe to spend, in other words.

Also, corporate profits in the third quarter increased an annualized 13.5 percent, following a 3.8 percent gain the previous period. Corporate profits are up 28.2 percent on a year-on-year basis. We doubt that corporate profits will continue to increase without more employment, because existing employees tend to demand higher wages when working longer hours, so it is cheaper to hire additional employees.

It therefore looks like consumers are not worried about inflation, as they mend their balance sheets. They are paying down their debts with a vengeance, while household deposits have increased a staggering 32 percent to $7.5 trillion in the past 5 years. They are also defaulting less on consumer and mortgage loans, reports Barron’s Magazine’s Jacqueline Doherty.

A major reason for the pickup on growth is the Fed’s efforts to maintain record low interest rates. And we see the Fed can do so for a “prolonged period” because they have no worries about inflation with unemployment so high—another reason we are seeing growth (and employment) picking up sooner rather than later.

Harlan Green © 2010

No comments:

Post a Comment