We have further confirmation that consumers have begun to spend again with all of 2010 retail numbers now in. We are also seeing employment picking up, and inflation remaining low, which is stretching the meager increases in consumers’ incomes.

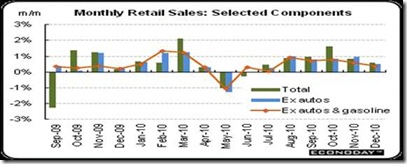

This is because holiday sales over the last two months have been quite good. But there are several stories in the details. Overall retail sales in December rose 0.6 percent after jumping 0.8 percent the month before.

A key source of strength in recent months has been autos which advanced 1.1 percent in December, following gains of 0.2 percent in November and 5.4 percent in October. For the latest month, excluding autos, sales were not quite as strong, rising 0.5 percent. With moderate pent up demand, this category likely will keep retail sales on an uptrend in coming months.

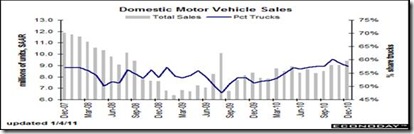

Motor vehicle sales have soared back to 2008 levels, as we have said, and look to climb further in 2011. Consumer spending continues to be concentrated in vehicle sales, which rose two percent in December to a 12.6 million annual rate vs 12.3 million in November.

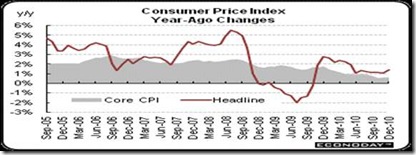

Higher oil prices are wreaking havoc with overall inflation numbers. But energy price pressures have had little impact on core CPI inflation, says Econoday. The CPI in December jumped 0.5 percent, following a modest 0.1 percent rise the month before. The December boost was the largest since a 0.7 percent surge in June 2009. Excluding food and energy, CPI inflation was just 0.1 percent, equaling the rise for November.

Year-on-year, overall CPI inflation rose to 1.4 (seasonally adjusted) from 1.1 percent in November. The core rate, however, eased 0.6 percent from 0.7 percent. On an unadjusted year-ago basis, the headline number was up 1.5 percent in December while the core was up 0.8 percent.

Disposable income growth (i.e., after taxes) slowed in November after a sizeable October boost, and has flattened out since its initial spurt in May 2010. But consumer spending was relatively healthy heading into the holiday shopping season. As in recent months, core inflation is quite soft and still below the Fed's target range. Personal income in November rose 0.3 percent, following a 0.4 percent boost in October. However, the wages & salaries component was sluggish, edging up 0.1 percent after jumping 0.5 percent in October.

The ‘real’ question is when wages & salaries growth exceed inflation with the increased hiring. That hasn’t been the case for most of the past 30 years, which is why consumers have gone so heavily in debt. Year on year, personal income for November posted a 3.8 percent gain, compared to 3.9 percent in October. In fact, it is only because inflation is muted that incomes are improving at all.

Harlan Green © 2011

No comments:

Post a Comment