Financial FAQs

Why does the final debt ceiling agreement look like 1938, when Republicans took over Congress after President Roosevelt ok’ed spending cuts while raising some taxes? Because Congress may make the same mistake—a repeat of the Great Depression by cutting spending when the U.S. economy hasn’t recovered from the Great Recession.

Democrats lost 71 House seats and 8 Senate seats in the 1938 election, after Roosevelt had been persuaded by his advisors cut back on New Deal programs, which precipitated the 1937-38 second depression and gave Republicans ammunition to say the New Deal hadn’t worked. Production, profits and wages had regained their 1929 levels by the spring of 1937. Unemployment remained high, but was considerably lower than the 25 percent rate seen in 1933.

So in June 1937, some of Roosevelt's advisors urged spending cuts to balance the budget. WPA rolls were drastically cut and PWA projects were slowed to a standstill, according to Wikipedia. The American economy took a sharp downturn in mid-1937, lasting for 13 months through most of 1938. Industrial production declined almost 30 per cent and production of durable goods fell even faster.

Does this look terribly familiar? In other words, we might be doomed to repeat the historical mistake of listening to creditors to whom so much of the federal debt is owed by cutting spending without creating jobs, when we should be stimulating growth both to reduce the ratio of debt to GDP and help debtors repay their debts.

The new agreement doesn’t allow any revenue increases in the first stage of some $2.1-2.4 trillion in mandated spending cuts over the next 10 years. This of course means the debt isn’t being paid down. All of the Bush tax cuts had added $3.7 billion to the $14 trillion in debt, with tax loopholes extended for energy and agribusiness, two wars and two recessions making up most of the rest. The spending cuts weren’t paid for then, and aren’t being paid for now, in other words.

But, had we continued the stimulus spending of 2009-10 that included the $787 Billion in ARRA stimulus, spent more of the $11 billion set aside for the HAMP mortgage modification program, and extended the homebuyer tax credits that expired last June, we might have started both a real estate recovery and longer term economic growth.

Instead, we are close to a ‘double-dip’ after just leaving the Great Recession. The first part of the Great Depression actually ended in 1934, which lulled everyone into believing that cutting spending in 1937 would do little harm. But it just made the Depression worse, until spending from government debt that topped 122 percent of GDP during World War II ended the Great Depression!

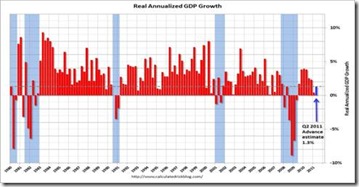

So history is very clear on what it takes to stimulate jobs and economic growth—more spending on policies that produce growth. That is the only way to bring down the debt level. But one can’t borrow for the wrong things, such as tax cuts. As one pundit put it, business doesn’t care where the dollars come from—a public or private worker. Calculate Risk has kept tabs on the possibility of a double-dip recession and second quarter numbers show the economy has almost ground to a halt. GDP growth revisions show Q1 2011 rose just 0.4 percent and Q2 1.3 percent in the ‘advance estimate’.

Personal Consumption Expenditures, which account for almost 70 percent of activity, have been falling for just the past 3 months for a number of reasons, including a spike in energy and food prices, and falling vehicle sales due to the Japanese Tsunami. It is why GDP growth has slowed so drastically. There are 4 indicators used by the National Bureau of Economic Research Business Dating Committee to determine a recession—employment, personal income less transfer payments, real GDP growth, and industrial production. Of the 4, industrial production and GDP growth have recovered the most.

There is some hope with the July Institute of Supply Management non-manufacturing survey that showed overall service sector activity had risen 2.7 percent in 12 of its 18 industries, which account for more than 70 percent of all economic activity. So we have not yet entered a double-dip. But without a viable job creation program, that may still happen.

So history as well as basic economics tells us those who want to shrink government by slashing spending without programs that also grow the economy are wrong. What would it take to convince them otherwise? Another Great Depression, or a Great War?

Harlan Green © 2011

Why does the final debt ceiling agreement look like 1938, when Republicans took over Congress after President Roosevelt ok’ed spending cuts while raising some taxes? Because Congress may make the same mistake—a repeat of the Great Depression by cutting spending when the U.S. economy hasn’t recovered from the Great Recession.

Democrats lost 71 House seats and 8 Senate seats in the 1938 election, after Roosevelt had been persuaded by his advisors cut back on New Deal programs, which precipitated the 1937-38 second depression and gave Republicans ammunition to say the New Deal hadn’t worked. Production, profits and wages had regained their 1929 levels by the spring of 1937. Unemployment remained high, but was considerably lower than the 25 percent rate seen in 1933.

So in June 1937, some of Roosevelt's advisors urged spending cuts to balance the budget. WPA rolls were drastically cut and PWA projects were slowed to a standstill, according to Wikipedia. The American economy took a sharp downturn in mid-1937, lasting for 13 months through most of 1938. Industrial production declined almost 30 per cent and production of durable goods fell even faster.

Does this look terribly familiar? In other words, we might be doomed to repeat the historical mistake of listening to creditors to whom so much of the federal debt is owed by cutting spending without creating jobs, when we should be stimulating growth both to reduce the ratio of debt to GDP and help debtors repay their debts.

The new agreement doesn’t allow any revenue increases in the first stage of some $2.1-2.4 trillion in mandated spending cuts over the next 10 years. This of course means the debt isn’t being paid down. All of the Bush tax cuts had added $3.7 billion to the $14 trillion in debt, with tax loopholes extended for energy and agribusiness, two wars and two recessions making up most of the rest. The spending cuts weren’t paid for then, and aren’t being paid for now, in other words.

But, had we continued the stimulus spending of 2009-10 that included the $787 Billion in ARRA stimulus, spent more of the $11 billion set aside for the HAMP mortgage modification program, and extended the homebuyer tax credits that expired last June, we might have started both a real estate recovery and longer term economic growth.

Instead, we are close to a ‘double-dip’ after just leaving the Great Recession. The first part of the Great Depression actually ended in 1934, which lulled everyone into believing that cutting spending in 1937 would do little harm. But it just made the Depression worse, until spending from government debt that topped 122 percent of GDP during World War II ended the Great Depression!

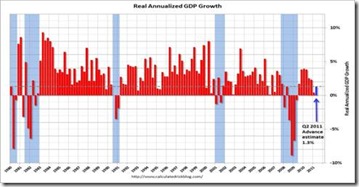

So history is very clear on what it takes to stimulate jobs and economic growth—more spending on policies that produce growth. That is the only way to bring down the debt level. But one can’t borrow for the wrong things, such as tax cuts. As one pundit put it, business doesn’t care where the dollars come from—a public or private worker. Calculate Risk has kept tabs on the possibility of a double-dip recession and second quarter numbers show the economy has almost ground to a halt. GDP growth revisions show Q1 2011 rose just 0.4 percent and Q2 1.3 percent in the ‘advance estimate’.

Personal Consumption Expenditures, which account for almost 70 percent of activity, have been falling for just the past 3 months for a number of reasons, including a spike in energy and food prices, and falling vehicle sales due to the Japanese Tsunami. It is why GDP growth has slowed so drastically. There are 4 indicators used by the National Bureau of Economic Research Business Dating Committee to determine a recession—employment, personal income less transfer payments, real GDP growth, and industrial production. Of the 4, industrial production and GDP growth have recovered the most.

There is some hope with the July Institute of Supply Management non-manufacturing survey that showed overall service sector activity had risen 2.7 percent in 12 of its 18 industries, which account for more than 70 percent of all economic activity. So we have not yet entered a double-dip. But without a viable job creation program, that may still happen.

So history as well as basic economics tells us those who want to shrink government by slashing spending without programs that also grow the economy are wrong. What would it take to convince them otherwise? Another Great Depression, or a Great War?

Harlan Green © 2011

No comments:

Post a Comment