The Mortgage Corner

Home prices are continuing to rise, in part because foreclosure rates continue to fall. Fannie Mae reported that the Single-Family Serious Delinquency rate declined in April to 2.93 percent from 3.02 percent in March. The serious delinquency rate, covering loans 90 days or more delinquent or in foreclosure, is the lowest level since January 2009.The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59 percent.

Foreclosed homes tend to sell for 33 percent less than normal market prices, which depresses housing values. So the drop in foreclosures means fewer homes are sold at under market prices.

Freddie Mac reported that the Single-Family serious delinquency rate declined in April to 2.91 percent from 3.03 percent in March. Freddie's rate is down from 3.51 percent in April 2012, and this is the lowest level since June 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20 percent.

This is while CoreLogic reported home prices nationwide, including distressed sales, increased 12.1 percent on a year-over-year basis in April 2013 compared to April 2012. This change represents the biggest year-over-year increase since February 2006 and the 14th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 3.2 percent in April 2013 compared to March 2013.

Excluding distressed sales, home prices increased on a year-over-year basis by 11.9 percent in April 2013 compared to April 2012, but longer-term housing prices will rise faster when excluding distressed sales, says CoreLogic. This is because CoreLogic’s distressed sales include short sales and real estate owned (REO) transactions, which could boost overall prices over the short term due to the high demand by investors who are buying up many in bulk.

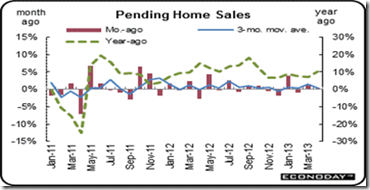

More evidence that the lack of homes on the market has been driving up prices is pending home sales, or homes under contract but not yet closed, which rose only 0.3 percent in April, following a 1.5 percent boost the month before.

Graph: Econoday

The National Association of Realtors Pending Home Sales Index reports home contract activity was at the highest level since the index hit 110.9 in April 2010, immediately before the deadline for the home buyer tax credit. Pending sales have been above year-ago levels for the past 24 months.

And Econoday reports “a regional look shows the effect of tight inventory which is most severe in the West and where pending home sales fell 7.6 percent. Price data from the West, in reports such as Case-Shiller, have been showing the very sharpest gains. Home-price appreciation is a very big story right now in the economy and this report points to continued upward pressure.”

The bottom line is activity in the housing sector is heating up with April existing-home sales rising 0.6 percent to an annual rate of 4.97 million, according to the National Association of Realtors. Sales of single-family homes, the most important component in the report, rose 1.2 percent in the month

Supply, which had been very tight, poured into the market during April with 230,000 units added to lift the months supply to 5.2 from 4.7 months. The median time for a house on the market fell dramatically, to 46 days vs 62 days in March.

And sellers are getting their price based on the report's price data. After jumping 6.2 percent in March, the median price rose another 4.8 percent in April to $192,800 which is the highest level of the recovery. We should note that price data in this report, which are not based on repeat transactions, are often volatile. But who can argue with a double digit year-on-year median gain of 11.0 percent?

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen

2 comments:

Hello to every one, the contents existing at

this web site are really awesome for people knowledge, well,

keep up the good work fellows.

Take a look at my weblog: teenpornpost.com

Also, we need to determine the rounds of the

quiz according to it. I believe my exact words were "I don't want to be your dirty little secret. The food is decent and the drink specials on Tuesdays include $2.

Here is my web blog free pub quiz and answers

Post a Comment