Financial FAQs

We could be back in the ‘goldilocks’ economy that was talked about several years ago. Growth is not too hot or too cold as we near full employment with very little inflation. It means the U.S. economy isn’t yet close to over-heating. In fact, the reason there is such low inflation is because GDP growth hasn’t been able to break out of the 2 percent range. And what will happen if it does?

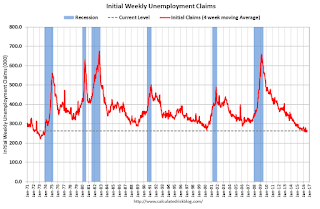

For starters, weekly initial jobless claims keep falling. “In the week ending August 6, the advance figure for seasonally adjusted initial claims was 266,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 269,000 to 267,000, according to the Labor Department.” There were no special factors impacting this week's initial claims. This marks 75 consecutive weeks of initial claims below 300,000, the longest streak since 1970, said the Labor Department.

And we are seeing almost no inflation. The retail Consumer Price Index is sticking to a 1 percent inflation rate of late and has been close to zero in the past year—which is scary. At any other time, it would be a sign of impending recession, but not in a economy close to full employment with more than 7 million still looking for full time work, and a BLS JOLTS report that says there are 5.6 million job openings.

Graph: Trading Economics

Why so little inflation with so many jobs being created? Low commodity prices, such as for oil, still at post-recession lows, are hurting the mining and energy sectors, which have laid off workers. The latest Producer Price Index for final demand has fallen to -0.2 percent year-over-year, and is up just 0.7 percent over the past year, even excluding food and energy prices.

Though most product costs come from labor costs, and the so-called Employment Cost Index has been barely rising. Compensation costs for civilian workers increased 2.3 percent for the 12-month period ending in June 2016, vs. 2.0 percent in June 2015, reports the Bureau of Labor Statistics. Wages and salaries increased 2.5 percent for the current 12-month period, vs. 2.1 percent for the 12-month period ending in June 2015.

Lastly, the so-called JOLTS report shows employment still expanding. The number of job openings was at 5.624 million on the last business day of June, up slightly from 5.514 million in May, the U.S. Bureau of Labor Statistics reported last week.

This is huge, with a total 5.1 million new jobs being created last month. The number of job openings is up 9 percent YoY, and the number of ‘Quits’ (those leaving their job voluntarily) is up 6 percent YoY, usually because they were able to find a better job, or are retiring.

So a goldlilocks-type economy is really a two-edged sword. Such low inflation means we aren’t able to return to the 3.2 percent average growth rate that has prevailed since WWII.

And we know why. Labor costs, which account for two-thirds of product costs, aren’t rising much above the inflation rate as most business profits are either saved or go to stockholders, rather than the employees who would spend it, thus putting the money back into circulation. It also means a large segment of the working population still lives at or below the poverty line.

Harlan Green © 2016

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment